Ever found yourself canceling streaming subscriptions, skipping your daily latte, and sneaking into your piggy bank just to feel safer with money?

Welcome to the world of revenge saving — the personal finance movement turning overspending remorse into financial resilience.

Why “Revenge Saving” Is Trending Now

In 2025, a fascinating shift is happening in how Americans react to economic stress. After periods of inflation, supply chain disruption, and rising costs of living, many are no longer leaning into indulgent spending. Instead, they’re going hard into revenge saving — that is, aggressively prioritizing saving and rebuilding buffers after financial strain.

This is more than a fad. It’s becoming part of a broader narrative of financial resilience, where people want not just growth in their wealth, but stability and protection.

A recent article in Kiplinger explored “The Rules of Revenge Saving,” highlighting how Americans are turning pandemic-era habits of splurging or “retail therapy” into renewed discipline. (Kiplinger)

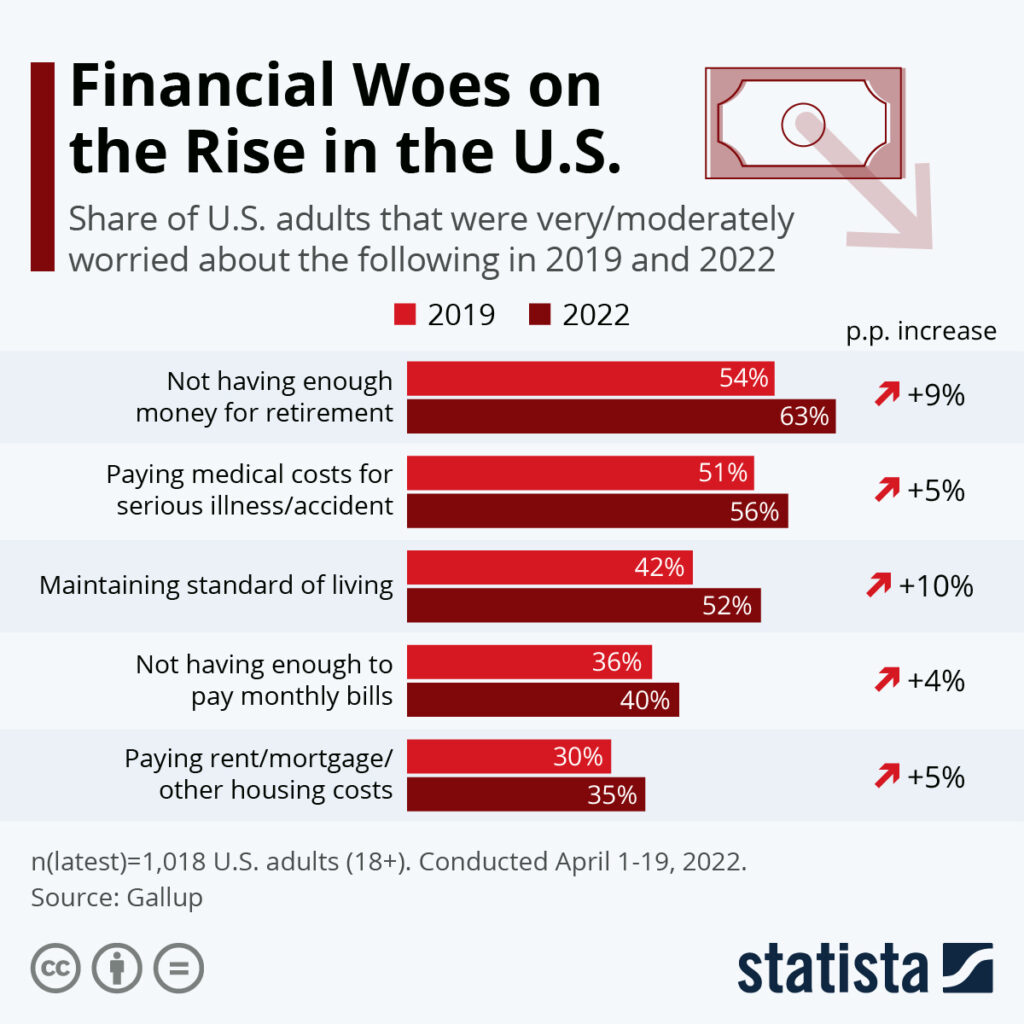

Meanwhile, surveys show a stark picture: one-third of U.S. adults are currently in financial trouble or crises. (Ramsey Solutions) That kind of stress often sparks the shift from reactive coping to strategic saving.

So let’s unpack what revenge saving really means, why it’s resonating, and how you can ride (or resist) the wave — all while keeping your sanity intact.

What Exactly Is Revenge Saving?

“Revenge saving” is the flip side of retail therapy. Instead of spending to feel better, you respond to financial anxiety or guilt by doubling down on:

- Emergency funds

- Debt payoff

- Cash buffers

- Cutting discretionary expenses sharply

- Automating saving aggressively

It’s not about deprivation forever — it’s about recalibrating your habits so that your finances feel safe again.

Key features include:

- Short-term intensity — intense saving for a defined period

- Psychological relief — giving back control

- Goal-based mindset — “I’m saving toward X (e.g. buffer, down payment, zero debt)”

- Behavioral reset — breaking patterns of overspending or impulsive buys

Let’s dig deeper into why this has struck such a chord in 2025.

The Forces Behind the Surge

1. Fading economic confidence & recession fears

Americans are nervous. A survey found that 77% of U.S. respondents say they’ve changed their spending habits because of economic uncertainty; 58% expect a recession to come. (New York Post)

When optimism is shaky, people tend to retreat into known safe zones — like saving, cutting discretionary risk, reducing debt exposure.

2. Rising debt burdens & inflation at the door

Household debt in the U.S. has ballooned in recent years. Meanwhile, inflation remains a specter — squeezing margins. When high costs erode disposable income, people prefer to trade future aspirations (new gadget, vacation) for present security.

3. Behavioral backlash from overspending

For some, past overspending (during pandemic rebound, travel surges, etc.) led to regret. Revenge saving is a kind of behavioral “reset button” — a way to say, “I messed up, now I fix it.”

4. Social & cultural influence: the loud budgeting movement

The personal finance zeitgeist has shifted. “Loud budgeting” — openly talking about budgets, limiting expenses, and rejecting peer pressure to overspend — is catching on, especially among Gen Z. (HerMoney)

When your peers talk about saving, you’re less tempted to keep up with spending impulses.

5. Fintech tools & automated finance

Apps and fintech platforms have simplified saving (round-ups, micro-savings, auto-allocations). When technology removes friction, people find it easier to commit to revenge saving without constant decision fatigue.

AI-driven budgeting tools, envelope systems, and passive allocation strategies make it easier to stay consistent.

How Revenge Saving Plays Out (Tactics & Strategies)

Here’s how many people are actually doing revenge saving. Some of these may sound extreme — use what fits your lifestyle.

A. Automate EVERYTHING

- Set up auto-transfers immediately on your paydays

- Use “round-up apps” that save spare cents to a buffer

- Segment accounts: emergency fund, short-term goal, bigger goals

Automation reduces the need for willpower.

B. Slash discretionary spending ruthlessly

- Pause subscription services

- Limit dining out or limit to one treat per week

- Freeze impulse shopping (e.g. “30-day wait rule”)

- Use cash or envelope systems for certain categories

For a short period, luxury or “fun” spending takes a backseat.

C. Debt payoff as priority

- Target high-interest debt (credit cards, personal loans)

- Snowball or avalanche methods

- Use extra savings to pay down principal

Some treat payoff as part of revenge saving — the fewer liabilities, the safer you feel.

D. Rebuild buffer first, then stretch

- Aim for 3–6 months’ expenses in a liquid emergency fund

- Once buffer is solid, shift excess to medium/long-term goals

The buffer gives psychological safety — a foundation to restart growth.

E. Temporary challenges or sprints

- Do a “Revenge Save Month” — pick one month to save extra aggressively

- Use micro-challenges: reduce “fun” expenses by X% daily

- Track progress visibly (graphs, charts, dashboards)

Gamifying the phase makes it more tolerable.

The Risks & Pitfalls (Don’t Crash Hard After the Sprint)

Yes, revenge saving can be empowering — but it comes with traps. Here are things to watch out for:

- Burnout & rigidity

Go too strict, too long, and you might snap back with overspending binges. - Neglecting joy / quality of life

You don’t want your finances to feel so sterile that life becomes joyless. - Ignoring growth opportunities

If investing or strategic spending (e.g. upskilling) gets squashed entirely, you may lose momentum. - Liquidity mismatch or too aggressive illiquidity

Avoid parking all your savings in illiquid assets if you might need cash unexpectedly. - Psychological stress / anxiety loop

If you treat saving as punishment, you may overcorrect or develop unhealthy money mindsets.

Revenge Saving + Financial Resilience: A Balanced Approach

Revenge saving ideally becomes a stepping stone, not a lifestyle prison. The goal is financial resilience: the ability to absorb shocks, stay calm, and stay on path toward longer-term goals.

Here’s a balanced framework:

- Phase 1: Immediate Reset (1–3 months)

Focus heavily on saving, scaling back expenses, paying down high-interest debt.

Your priority: safety first. - Phase 2: Maintain + Regrow (3–12 months)

Reintroduce measured growth spending (e.g. education, investment) while retaining core buffer and discipline. - Phase 3: Sustainable Growth (>12 months)

Evolve into a model of balanced spending, investing, giving, with continued emphasis on avoiding reckless financial swings.

During this journey, maintain flexibility, metrics, and mindful review (quarterly financial check-ins).

Why This Topic Matters for 2025

Over the past year, trends in personal finance and fintech confirm this shift:

- Digital banking and mobile-first banking continue to gain ground, especially among younger generations, as people move away from legacy institutions. (GWI)

- Buy Now, Pay Later (BNPL) models are expanding — but some consumers are pushing back, favoring saving instead of accruing new debt. (Glimpse)

- Consumer mindset shift: 79% of consumers say they are more cautious with spending now. (GWI)

- Loud budgeting and “no-spend / underconsumption” challenges are headline topics in many personal finance blogs. (HerMoney)

Imagine Jenna, age 29, working in tech in Austin, TX. Over the last two years she upgraded her lifestyle — took more weekend trips, tried boutique gyms, bought gadgets. Then came inflation, salary freezes, and increased costs. She felt squeezed.

One day she woke up, looked at her credit card bill, and said: “I need a reset.”

- Jenna canceled half her streaming / subscription services.

- She rerouted $500/month automatically into a high-yield savings buffer.

- She paused fashion spending, plugged in a 30-day wait rule for non-essentials.

- She prioritized her card with ~19% APR and threw extra buffer money at it.

- Over three months, she built a buffer equal to 4 months of basic living + eliminated the credit card.

Now Jenna feels safer. She reintroduced small discretionary spending (coffee out, a modest vacation), but with new filters. She continues automating buffer growth and investing part of her income.

She used revenge saving not as punishment, but as a restart tool.

Tips to Make a Revenge Saving Sprint Work for You

Here’s a practical checklist:

- Set a time-bound sprint — e.g. 6 weeks or 3 months

- Cluster your finances — separate “sprint money” vs. “baseline money”

- Use visual dashboards — seeing your buffer climb is motivating

- Allow small joys — e.g. one “fun” line item per month

- Check in weekly / biweekly — assess mood, stress, adjust

- Plan reintroduction — define what “normal” looks like after sprint

Also, be kind to yourself: missed a week? Not a failure — just adjust.

Supporting Stats & Market Signals

- One third of Americans say they are in financial crisis / struggle. (Ramsey Solutions)

- In August 2025, top finance websites in U.S. include PayPal, Chase, CapitalOne, Chime — reflecting how digital / fintech brands are central to consumer finance. (Semrush)

- In consumer finance surveys, 79% say they prefer being cautious with spending amid uncertainty. (GWI)

These data points reinforce that many people are leaning toward safety, caution, and reconnection with control.

How Brands, Advisors & Fintechs Can Ride This Wave

If you’re a content creator, financial advisor, fintech founder, or brand in the space, here’s how to align:

- Content on “revenge saving guides”

Create step-by-step sprints, case studies, templates. - Tools & calculators

Emergency fund calculators, buffer progress visualizers, payoff planners. - Behavioral nudges & notifications

Gentle reminders, motivational messages on progress, mini saving challenges. - Trust & transparency (E-E-A-T matters more in finance)

Because finance is YMYL (“Your Money or Your Life”), Google emphasizes trust, authority, and accuracy. (Promodo) - Personalization & segmentation

Recognize who’s coming off overspending, debt stress, or wanting to rebuild. Tailor suggestions to intensity level. - Community / social proof

Use “loud budgeting” style features — let users share small wins, budgets, goals (if they choose).

FAQs:

Is revenge saving just extreme frugality?

No — it’s a short-term response to financial anxiety, not necessarily a permanent rulebook of austerity.

How long should I do a sprint?

6 to 12 weeks is a reasonable timeframe. Anything much longer increases risk of burnout.

What if I need flexibility (kids, irregular income, debt)?

Adjust the intensity, buffer grace months, allow for “wiggle room.” The point is control, not rigidity.

Can I invest while doing revenge saving?

It’s okay to keep minimal investing (e.g. your regular 401(k) contributions) if it doesn’t derail the sprint. But your top priority should be buffer + debt control.

What’s the “exit strategy”?

Define your post-sprint state (e.g. buffer = 4 months, no credit card debt) and slowly transition to balanced growth.

Conclusion

We’re living in times of uncertainty — from inflation to shifting job markets to consumer sentiment swings. In that context, revenge saving is gaining traction as a way to re-anchor finances, restore psychological control, and build long-term resilience.

But it doesn’t have to be all or nothing. Use the idea of a sprint or reset to restart good habits, rebuild buffers, and get back your financial confidence. And once that foundation is solid, shift toward sustainable growth with intentional spending, investing, and generosity.

Here’s your next step:

- Pick a time frame (6, 8, or 12 weeks).

- Automate a fixed portion of income into a buffer or debt payoff.

- Cut one nonessential expense.

- Track weekly and adjust.

- After the sprint, plan your “after-sprint budget”: how much you reintroduce to growth, lifestyle, fun.